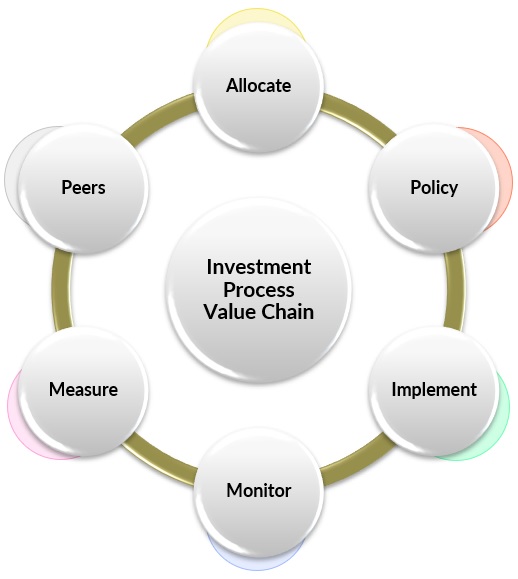

InsurerCIO: Tools & Resources to Support the Investment Process

InsurerCIO, provided by Strategic Asset Alliance, is a complimentary membership for insurance companies and government risk pools to learn the essential elements of investing, track the latest industry trends & best practices, and access analytical tools to support each component of the investment process.

Process Value

Chain

Asset Allocation & Risk Appetite Platform >>

InsurerCIO’s Portfolio Analytics >>

Essentially, Asset Allocation is your company’s investment strategy; the types and quantity of investments based on desired return, tolerable (potential) risk of loss and organization goals.

Tools: Asset Allocation Platform

Click Here to View Platform >>

Resources: Primers & Board Education

The Investment Policy identifies your investment objectives and the role/restrictions of all parties involved in the process. The policy also helps prevent any problematic actions from happening.

Tools: Investment Policy Generator

Click Here to View Generator >>

Resources: Primers & Board Education

Whether internal or managed by a third-party, Investment Management must be aligned with your organization from a philosophical and personnel perspective, not just performance.

Tools: Manager Select Database

Click Here to View Database >>

Resources: Primers & Board Education

Portfolio Monitoring goes beyond tracking what your manager(s) has been doing, it is important to observe how the portfolio is acting in accordance with compliance, risk exposures, stress testing, etc.

Tools: InsurerCIO.com

Click Here to Become a Member >>

Resources: Primers & Board Education

Aside from reviewing your level of return, your organization's Performance Measurement should analyze “why” the portfolio performed the way it did and adjust performance to the level of risks being taken.

Tools: InsurerCIO’s Portfolio Analytics

Click Here to View Analytics Tool >>

Resources: Primers & Board Education

It is important for insurers & risk pools to use Peer Analysis to compare their portfolio to similar entities as a measure of performance and to identify potential improvements.

Structured Peer Group

Click Here to Learn More >>

Risk Pool Peer Group

Click Here to Request Access >>

Tools & Resources:

(Click to Expand Sections)

Essentially, Asset Allocation is your company’s investment strategy; the types and quantity of investments based on desired return, tolerable (potential) risk of loss and organization goals.

Tools: Asset Allocation Platform

A simplified platform that easily models various allocation scenarios to determine your company's risk appetite and expected portfolio return.

Click Here to View Platform >>

Resources: Primers & Board

Education

Case Studies >> |

Asset Allocation >> |

Fixed Income >> |

Risk Assets Primer >> |

Portfolio Diversification >> |

Efficient Frontier Overview >>

The Investment Policy identifies your investment objectives and the role/restrictions of all parties involved in the process. The policy also helps prevent any problematic actions from happening.

Tools: Investment Policy Generator

An easy-to-use tool to generate and update your company's Investment Policy, while implementing "Best Practices."

Click Here to View Generator >>

Resources: Primers & Board Education

Case Studies >> |

Best Practices Overview >> |

Credit Ratings/Agency Overview & Glossaries >> |

SWOT Overview >>

Whether internal or managed by a third-party, Investment Management must be aligned with your organization from a philosophical and personnel perspective, not just performance.

Tools: Manager Select Database

A proprietary database of more than 75 fixed income managers with insurance specialization. This database provides comparisons for fees, performance, etc.

Click Here to View Database >>

Resources: Primers & Board Education

Case Studies >> |

Active vs. Passive Overview >> |

Fixed Income Levers >> |

SWOT Overview >> |

Key Questions to Ask >> |

SMA vs. Funds >>

Portfolio Monitoring goes beyond tracking what your manager(s) has been doing, it is important to observe how the portfolio is acting in accordance with compliance, risk exposures, stress testing, etc.

Tools: InsurerCIO.com

InsurerCIO, provided by SAA, is a resource center for insurers and risk pools to stay up-to-date on the latest trends and insights impacting insurer investments each quarter

Click Here to Become a Member >>

Resources: Primers & Board Education

InsurerCIO Newsletter & Insights >> |

Glossary of Key Terms >> |

Overview of Key Charts to Review >>

Aside from reviewing your level of return, your organization's Performance Measurement should analyze “why” the portfolio performed the way it did and adjust performance to the level of risks being taken.

Tools: InsurerCIO’s Portfolio Analytics

A proprietary reporting platform that generates in-depth reports and analyses, ranging from asset allocation to OTTI, to correctly review your portfolio and measure performance.

Click Here to View Analytics Tool >>

Resources: Primers & Board Education

Primers & Board Education >> |

Capital Markets Review >> | Overview of Key Exhibits >> |

SWOT Overview >> |

Primer: Understanding Key Reports >>

It is important for insurers & risk pools to use Peer Analysis to compare their portfolio to similar entities as a measure of performance and to identify potential improvements.

Structured Peer Group

SAA provides peer analysis that looks at the financial results and portfolio composition in comparison with peers of a similar asset size and line of business.

Click Here to Learn More >>

Risk Pool Peer Group

For Government Risk Pools, SAA maintains a database of 23 risk pooling clients and additional non-client pools that have supplied verified data for the provided blind peer analyses.

Click Here to Request Access >>