Peers: SAA's Pool Peer Database

Through SAA's work with Government Risk Pools, InsurerCIO has been able to develop a proprietary database for Pools to compare their company directly with other Pooling organizations in a blind peer analysis.

The database currently consists of 24 risk pooling clients plus additional non-client pools that have supplied verified data for the provided peer analyses.

You can request access or review a sample peer analysis here >>

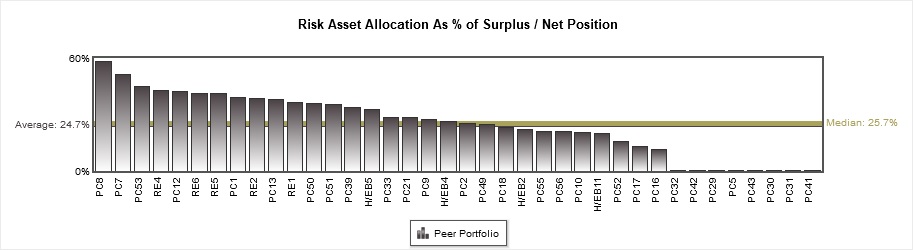

You can join the database and anonymously include your Pool's data to compare key elements of your investment process, such as Risk Asset Allocation as % of Surplus, Invested Assets/Surplus, Manager Fees Comparison, Operating Leverage and Financial Leverage.

Sample Pool Peer Group: 'Risk Assets as a % of Surplus'

Broadly indicates your company's allocation to "risk assets" relative to your peers. Risk assets include high yield bonds, bank loans, real estate, common stock, preferred stock, and equity funds. An increase in your risk allocation should be yielding an appropriate increase in return. If your company is depicted as relatively lower, it is important to consider if any added benefits could be gained from your portfolio adjusted for risk. For pools that are restricted from holding risk assets, additional options may include forming a captive pursuant to applicable laws.